Introduction to Shipping in Actinic

Actinic provides a selection of tools to help you charge your customers for having their orders shipped to them.

There are two basic approaches to working out shipping charges:

· Charge your customers a basic amount for the whole order, or a basic shipping charge for each product.

· Calculate a more accurate shipping charge based on the content of the order, and where it is being sent.

Once you have decided which of the two approaches you want to choose, you can then use the tools within Actinic that are relevant to you. These are described below:

If you want to just charge a basic amount for the order, of for each item, then you can read more in Basic Shipping Charges.

If you want to charge based on where the order is being sent, and how large the order is, then you need to firstly read up about how to create geographical shipping zones, and create classes within those zones. This is described in Zones and Classes.

After you've done that, you then need to decide what aspect of the order you want to base your shipping calculation on. An overview of all the different bases of calculation is in Calculation Basis For Shipping and you will find details on each in the list below:

· For details on calculating shipping based on the total quantity of items in the order, go to Calculating Shipping Based on Quantity

· For details on calculating shipping based on the total value of the order, go to Calculating Shipping Based on Value

· For details on calculating shipping based on the type of items you are sending, go to Calculating Shipping Based on Category

· For details on charging shipping based on weight and/or volume, go to Calculating Shipping Based on Weight/Volume.

Finally, you might want to charge an additional handling charge on the order. Details of this are in Handling Charges

Initial Shipping Setup

Before you can get stuck into setting up how you are charging shipping, there are a few basic settings you need to sort out.

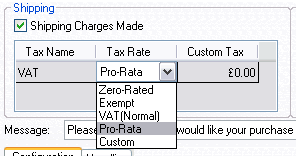

At the top left of the 'Shipping and Handling' tab is the 'Shipping Charges Made' box. If you de-select this box, then no shipping will be charged at your online store.

Then the 'Message' field is used to describe your shipping methods to your online customers. This text will appear in the 'Shipping' area of the checkout.

Tax

This grid is used to choose how tax is charged on your shipping prices. The names of the all taxes you have set up in 'Business Settings | Tax' will be listed in the 'Tax Name' column.

The options in the 'Tax Rate' drop down are as follows:

|

Option |

Meaning |

|

Taxable - i.e. the name of a tax is shown. |

The shipping charge will incur this tax when ordered. Customers online can be exempted from paying this tax, either automatically based on their location, or manually by selecting a box. For more information, go to Setting Up Tax. |

|

Zero-rated |

This shipping charge incurs the tax, but at a rate of 0.00% |

|

Exempt |

The shipping charge is exempt from this tax. |

|

Custom |

This option allows you to enter the amount of tax to be charged as an actual cost, rather than as a percentage of the shipping charge. You can enter this charge in the 'Custom Tax' box to the right when it becomes active. |

|

Pro-Rata |

This will apply tax on the shipping charge based on the tax statuses of the items in the shopping cart. If the shopping cart contains nothing but taxable items, then the shipping charge will incur the full tax rate. If the shopping cart contains nothing but zero-rated items, then the tax applied to the shipping charge will be zero-rated. Likewise, if all the items in the cart are exempt from tax, then the shipping charge will be exempt from tax. However, if the shopping cart contains a mixture of taxable and non-taxable items, then tax will be applied on the shipping charge based on the proportion of the value of the taxable goods vs. the non-taxable goods. |